Read time: 2m 45 read

Is the Dividend Tax going up?

You might well have missed it, but the Dividend Tax rate increased in April 2022. This means that the large number of business owners who pay themselves through dividends will have to pay extra when it comes to their annual tax bills.

The government made the decision to increase the tax by 1.25% to help pay for increased spending on health and social care, including a cap on social-care costs. National Insurance has also increased by 1.25 percentage points as part of the same policy.

With so much going on in the world, many entrepreneurs are likely to have missed the announcement, according to Simon Martin, Consultant at Technical Connection, St. James’s Place’s technical-support partner.

“I think there’ll be a significant percentage of business owners who haven't noticed there has been an increase,” he says. “Unlike PAYE income, you don’t see it through a payslip, where you can easily notice you’re receiving less: it’ll be the tax bill at the end of the year, and that won’t be until January 2024. I suspect a lot of people won’t realise until then.”

How are dividends taxed?

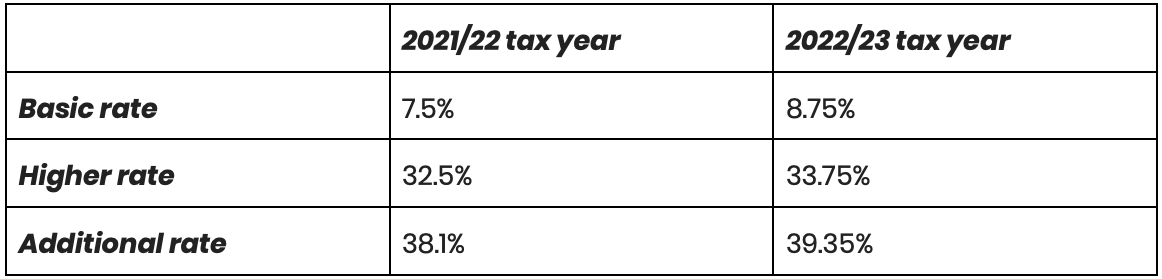

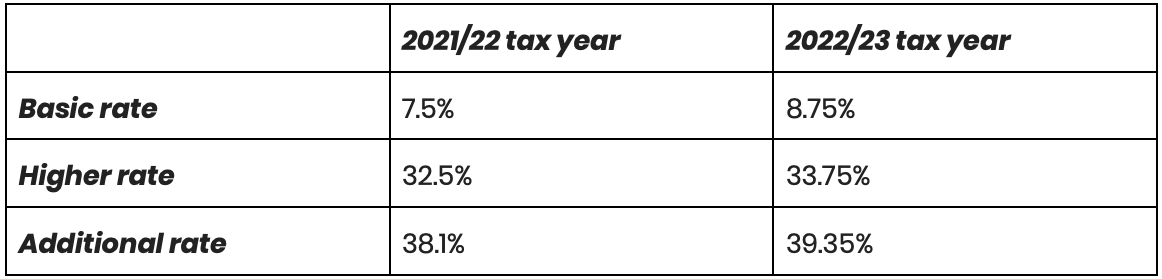

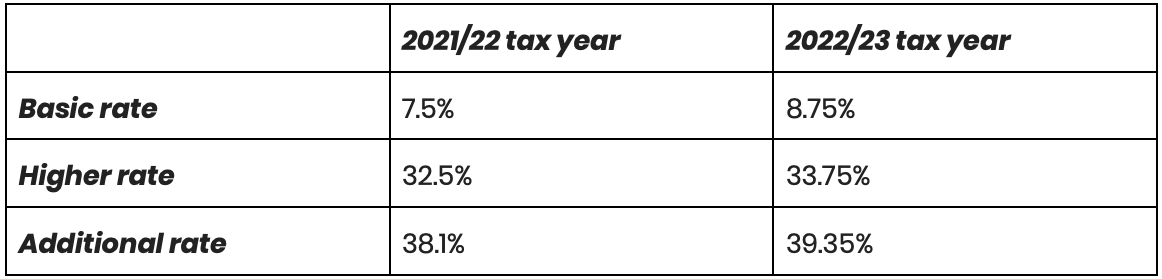

The amount of Dividend Tax you pay depends on the rate of Income Tax you pay. If you’re in a higher Income Tax band, your Dividend Tax will be higher. There’s a dividend allowance of £2,000, below which there’s no tax to pay.

What is the tax on dividends for 2022-23?

The recent increase in Dividend Tax affects anyone who pays themselves through dividends, with 1.25% added to the rate at each band.

How can I reduce my Dividend Tax?

The most common way to pay less Dividend Tax is to reduce the amount you pay in dividends. You can do this by increasing your payments through other methods of extracting business profits (see below).

However, this might not be the most tax-efficient way to extract profits, despite the increase in the Dividend Tax.

“By and large, dividends are still the most effective way of paying yourself,” says Simon. “It’s not going to be a huge increase for each individual. It’s unlikely to change how you fundamentally structure your remuneration.

“For the vast majority of people, salary and dividends, along with pension contributions, are going to be the most tax-efficient ways of being paid.”

What’s the best way to extract profits from your business?

There are three main ways to extract profits from your company. They are:

- Take a salary

- Pay pension contributions

- Pay a dividend

Typically, an entrepreneur will mix some or all of the above to ensure they make the most of the tax exemptions available. This is where it’s important to take advice and work out a tax-efficient plan.

By balancing different payments, you can reduce what you owe in tax. For example, the primary threshold for employee National Insurance contributions increases to £12,570 from July 2022. And as described above, the dividend allowance is £2,000.

Paying into a pension is generally the single most tax-efficient way of extracting profits from your business because you don’t pay National Insurance, Corporation Tax or Income Tax (until you draw down on the pension).

The annual allowance for paying into your pension pot before having to pay tax is £40,000, so it’s worth considering diverting some of your profit into retirement savings. However, unlike payment through salary or dividends, pension savings cannot be accessed until you’re 55.

Seek advice

Speak to us for advice on tax-efficient ways to make the most of your income to meet your future goals, from pensions to savings.

Read time: 2m 45 read

Is the Dividend Tax going up?

You might well have missed it, but the Dividend Tax rate increased in April 2022. This means that the large number of business owners who pay themselves through dividends will have to pay extra when it comes to their annual tax bills.

The government made the decision to increase the tax by 1.25% to help pay for increased spending on health and social care, including a cap on social-care costs. National Insurance has also increased by 1.25 percentage points as part of the same policy.

With so much going on in the world, many entrepreneurs are likely to have missed the announcement, according to Simon Martin, Consultant at Technical Connection, St. James’s Place’s technical-support partner.

“I think there’ll be a significant percentage of business owners who haven't noticed there has been an increase,” he says. “Unlike PAYE income, you don’t see it through a payslip, where you can easily notice you’re receiving less: it’ll be the tax bill at the end of the year, and that won’t be until January 2024. I suspect a lot of people won’t realise until then.”

How are dividends taxed?

The amount of Dividend Tax you pay depends on the rate of Income Tax you pay. If you’re in a higher Income Tax band, your Dividend Tax will be higher. There’s a dividend allowance of £2,000, below which there’s no tax to pay.

What is the tax on dividends for 2022-23?

The recent increase in Dividend Tax affects anyone who pays themselves through dividends, with 1.25% added to the rate at each band.

How can I reduce my Dividend Tax?

The most common way to pay less Dividend Tax is to reduce the amount you pay in dividends. You can do this by increasing your payments through other methods of extracting business profits (see below).

However, this might not be the most tax-efficient way to extract profits, despite the increase in the Dividend Tax.

“By and large, dividends are still the most effective way of paying yourself,” says Simon. “It’s not going to be a huge increase for each individual. It’s unlikely to change how you fundamentally structure your remuneration.

“For the vast majority of people, salary and dividends, along with pension contributions, are going to be the most tax-efficient ways of being paid.”

What’s the best way to extract profits from your business?

There are three main ways to extract profits from your company. They are:

- Take a salary

- Pay pension contributions

- Pay a dividend

Typically, an entrepreneur will mix some or all of the above to ensure they make the most of the tax exemptions available. This is where it’s important to take advice and work out a tax-efficient plan.

By balancing different payments, you can reduce what you owe in tax. For example, the primary threshold for employee National Insurance contributions increases to £12,570 from July 2022. And as described above, the dividend allowance is £2,000.

Paying into a pension is generally the single most tax-efficient way of extracting profits from your business because you don’t pay National Insurance, Corporation Tax or Income Tax (until you draw down on the pension).

The annual allowance for paying into your pension pot before having to pay tax is £40,000, so it’s worth considering diverting some of your profit into retirement savings. However, unlike payment through salary or dividends, pension savings cannot be accessed until you’re 55.

Seek advice

Speak to us for advice on tax-efficient ways to make the most of your income to meet your future goals, from pensions to savings.

Read time: 2m 45 read

Is the Dividend Tax going up?

You might well have missed it, but the Dividend Tax rate increased in April 2022. This means that the large number of business owners who pay themselves through dividends will have to pay extra when it comes to their annual tax bills.

The government made the decision to increase the tax by 1.25% to help pay for increased spending on health and social care, including a cap on social-care costs. National Insurance has also increased by 1.25 percentage points as part of the same policy.

With so much going on in the world, many entrepreneurs are likely to have missed the announcement, according to Simon Martin, Consultant at Technical Connection, St. James’s Place’s technical-support partner.

“I think there’ll be a significant percentage of business owners who haven't noticed there has been an increase,” he says. “Unlike PAYE income, you don’t see it through a payslip, where you can easily notice you’re receiving less: it’ll be the tax bill at the end of the year, and that won’t be until January 2024. I suspect a lot of people won’t realise until then.”

How are dividends taxed?

The amount of Dividend Tax you pay depends on the rate of Income Tax you pay. If you’re in a higher Income Tax band, your Dividend Tax will be higher. There’s a dividend allowance of £2,000, below which there’s no tax to pay.

What is the tax on dividends for 2022-23?

The recent increase in Dividend Tax affects anyone who pays themselves through dividends, with 1.25% added to the rate at each band.

How can I reduce my Dividend Tax?

The most common way to pay less Dividend Tax is to reduce the amount you pay in dividends. You can do this by increasing your payments through other methods of extracting business profits (see below).

However, this might not be the most tax-efficient way to extract profits, despite the increase in the Dividend Tax.

“By and large, dividends are still the most effective way of paying yourself,” says Simon. “It’s not going to be a huge increase for each individual. It’s unlikely to change how you fundamentally structure your remuneration.

“For the vast majority of people, salary and dividends, along with pension contributions, are going to be the most tax-efficient ways of being paid.”

What’s the best way to extract profits from your business?

There are three main ways to extract profits from your company. They are:

- Take a salary

- Pay pension contributions

- Pay a dividend

Typically, an entrepreneur will mix some or all of the above to ensure they make the most of the tax exemptions available. This is where it’s important to take advice and work out a tax-efficient plan.

By balancing different payments, you can reduce what you owe in tax. For example, the primary threshold for employee National Insurance contributions increases to £12,570 from July 2022. And as described above, the dividend allowance is £2,000.

Paying into a pension is generally the single most tax-efficient way of extracting profits from your business because you don’t pay National Insurance, Corporation Tax or Income Tax (until you draw down on the pension).

The annual allowance for paying into your pension pot before having to pay tax is £40,000, so it’s worth considering diverting some of your profit into retirement savings. However, unlike payment through salary or dividends, pension savings cannot be accessed until you’re 55.

Seek advice

Speak to us for advice on tax-efficient ways to make the most of your income to meet your future goals, from pensions to savings.